Accounting Treatment For Disposal Of Fixed Asset. Journal Entries in the books of Purchaser.

Tax Implications Of Financial Arrangements For Motor Vehicles Acca Global

Journal entry for disposal of motor vehicle under hire purchase Chapter 2 accounts of implementation of implementation of implementation of implementation of 1967 amendment and Islamic perspective 211 definition of purchase section 21 Law on the purchase of rental 1967.

. The purpose of this entry is to transfer the cost of the fixed asset to the asset disposal account. Asase Limited prepares accounts to 31 st December each year. You have put down a deposit down payment of RM7500000 which means the financed amount is RM10000000.

Assuming you purchase a new Office Equipment at. Road Tax Insurance Expenses Cr. Motor vehicle disposal account for GT400.

Extract of the profit and loss account. Assuming you purchase a new Office Equipment at 20000 and financed it with a Hire Purchase plan. If the total payments are only 8225 the HP company is not charging any interest.

Initial payment 10000 30 3000. DR BS Motor Vehicles 7000. CR Disposal of Motor Vehicle Account.

You are required to prepare. The accounting entry is to. CR Fixed Asset Account - Motor Vehicle.

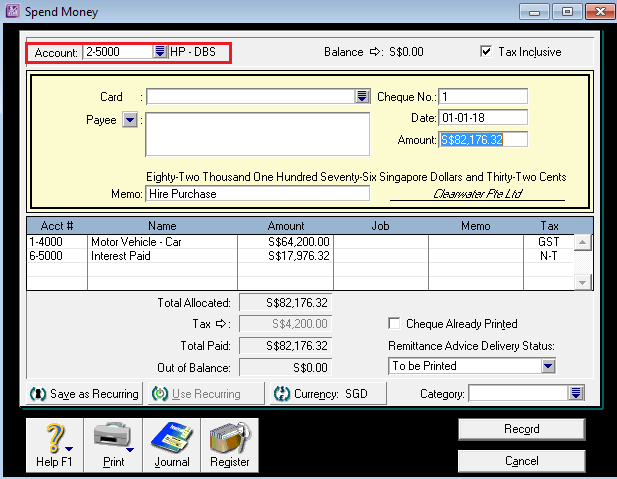

When I pay the down payment Debit Account payable 20000 Credit Bank 20000. This article demonstrates how you can record a hire purchase transaction of an asset with monthly instalment. To offset the Fixed Asset Account.

A fixed asset trade in journal entry is used to post the acquisition of a new motor vehicle in exchange for cash and a trade in allowance on an old vehicle. A and company ABC have made the hire purchase agreement of the car. When transactions or event happen we record them.

Deposit Paid Current Assets Cr. The hire-vendor treats the hire purchase sale like an ordinary sale. Lease accounting operating vs financing leases examples.

There are four methods of accounting for hire purchase. The car costs 10000 and it requires to pay 30 initial payment and the remaining balance will be paid monthly with interest expense. The double entry of the Enter Bill transaction.

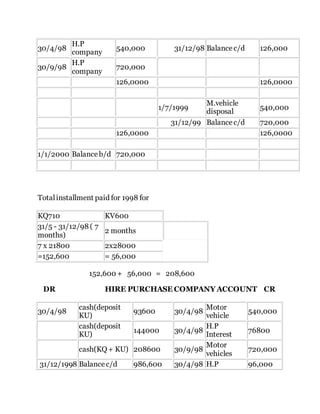

63900 x 35 month. The monthly payment over 3 years is equal to 200. Abby bought a car proton preve with hire purchase facility for amount of rm 75000 not included insurance of rm1130 road tax of.

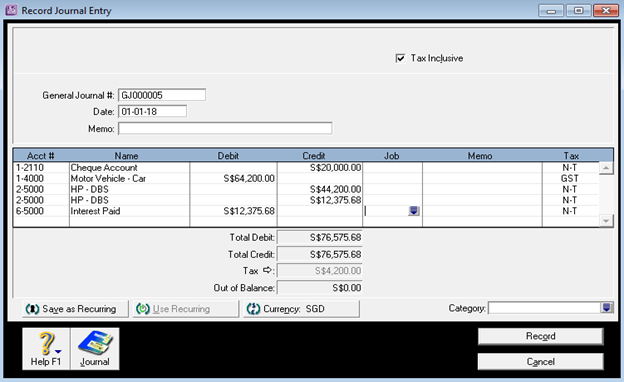

To offset the fixed asset account. Debit Cost of Office Equipment 15000 Debit GST Input. DR BS Motor Vehicles 7000.

First we need to calculate the loss on disposal of the old motor vehicle. A fixed asset trade in journal entry is used to post the acquisition of a new motor vehicle in exchange for cash and a trade in allowance on an old vehicle. Original cost 6349500 Motor Vehicles Sale price 6060000 inc 1010000 VAT Acc Dep 1269900 Outstanding Finance 5013113 HIre Purchase HP Interest 145460 HP Interest Paid to us 1046887 currently in our revenue account unreconciled VAT on the sale 1000000 I am really at a loss of how to do the.

300000 100000 3 years. Entries in Interest Account Depreciation Account and Profit Loss Account will be the same as have been passed under the first method. Provision for depreciation ac.

Vehicles such as vans are assets that will be used to produce money for the business over time. CR BS HP Liabilities 7000. Debit Accumulated Depreciation for the cars accumulated depreciation.

Credit Hire Purchase 19200. Total Interest charge base on 5 interest. You are acquiring a motor vehicle that costs RM17500000 with a 5-year hire purchase plan.

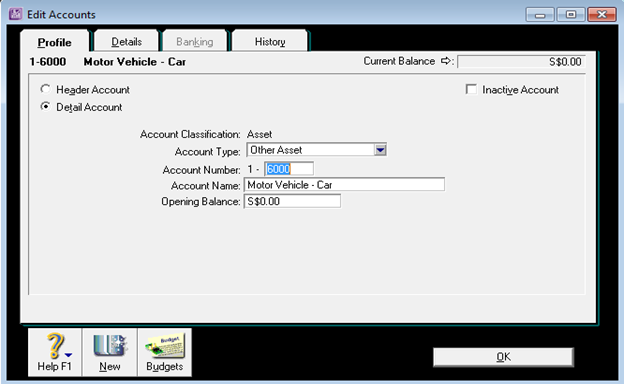

Motor Vehicle ABC XXXX Fixed Asset Dr. The interest rate per annum is 388 flat. Accounting for Disposal of Fixed Assets.

A disposal of fixed assets can occur when the asset is scrapped and written off sold for a profit to give a gain on disposal or sold for a loss to give a. HP Interest in Suspense ABC XXXX Negative Current Liability Cr. Lorry van and motorcycle that do not fall under the definition of a motor car the GST incurred for the purchase and running expenses of the motor vehicles are claimable subject to the conditions for.

The company depreciates its vehicles at the rate of 20 per annum using the straight line method on pro rata basis. You are acquiring a motor vehicle that costs RM17500000 with a 5-year hire purchase plan. The figures are as follows.

If the cash price was 7000 plus 1225 of VAT which was reclaimed as input tax the double entry is. When a business has a disposal of fixed assets the original cost and the accumulated depreciation to the date of disposal must be removed from the accounting records. When received part payment from buyer.

1050 Debit Interest in Suspense. The accounting rules require us to. The journal entries for the illustration number 3 given above under this method will be as under.

Hire Purchase ABC XXXX Current Liability 3 To Updated Hire Purchase Interest in Suspense. Amount Owing to Director Current Liabity Cr. When a fixed asset is disposed off.

Hi Can anyone guide me what is the accounting double entry for selling of Fixed Asset - A Car. In cases of small owner managed companies where a second hand car is the economic option it could be more effective for a sole director to purchase it himself and claim AMAP mileage allowances. Since it was exchanged for fair value of 5000 and had a net book value of 6000 17000 11000 the loss.

When I am purchased the car Debit Car 70000 Credit. When the hire purchase has been approved transfer from account payable to hire purchase creditor. For other motor vehicles eg.

P11D value Just a note of warning where a company buys a second hand car - the director will be taxed on the benefit at list price when new. 1050 Debit Interest in Suspense. You create both the Interest in Suspense and Hire Purchase account as a Long-Term Liability since the payment term is more than a year.

The accounting entries would be as follows. But this is not all. DR Disposal Of Motor Vehicle Account.

Provision for depreciation account. If the cash price was 7000 plus 1225 of VAT which was reclaimed as input tax the double entry is. Double entry for disposal of motor vehicle under hire purchase.

So what is the double entry for. Under cash price method we are deal hire purchase transactions just like normal transactions. Asset Account at Cost.

The double entry will be. The agreement that includes the assumption of goods and at the same time giving a.

Depreciation Of Vehicles Atotaxrates Info

Tax Implications Of Financial Arrangements For Motor Vehicles Acca Global

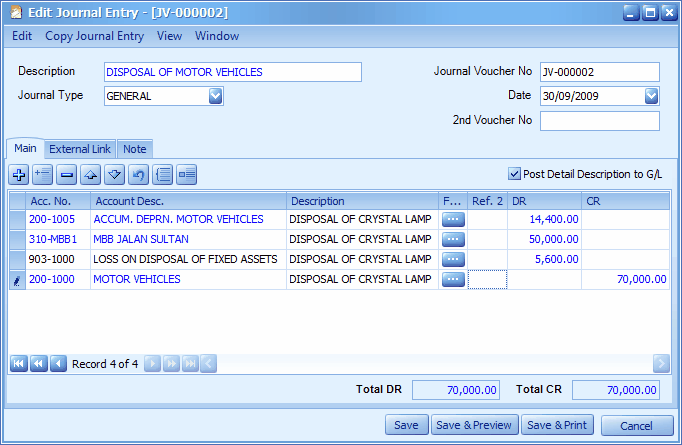

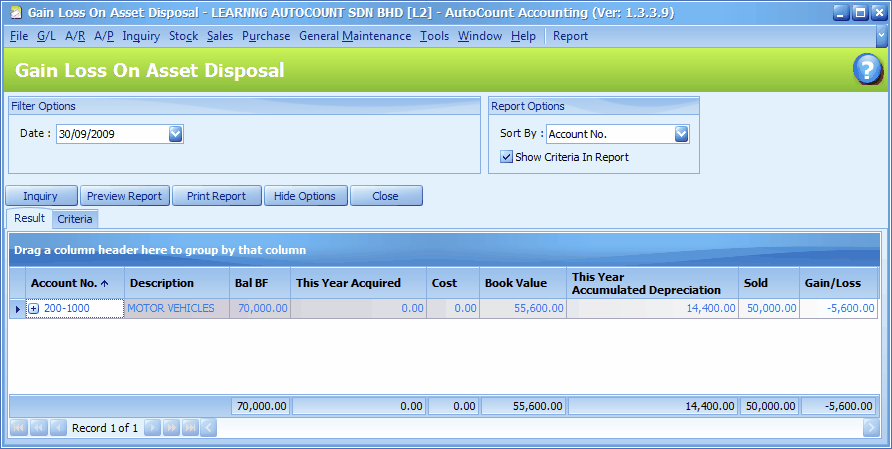

Autocount Accounting Help File 2009

Solved Journal Entries For Fixed Asset Sale Vehicle With

Autocount Accounting Help File 2009

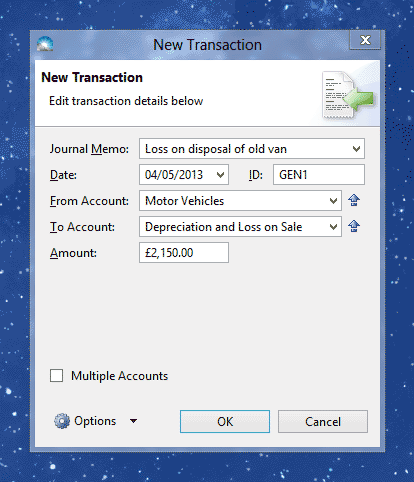

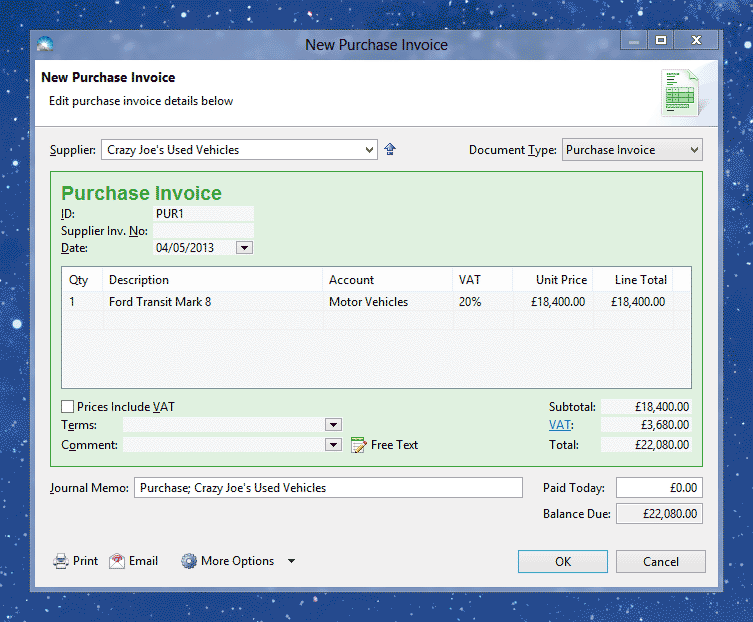

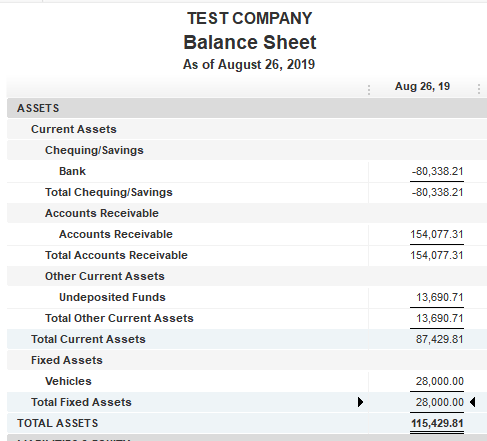

How To Record A Hire Purchase Agreement Solar Accounts Help

Accounting Basics Purchase Of Assets Accountingcoach

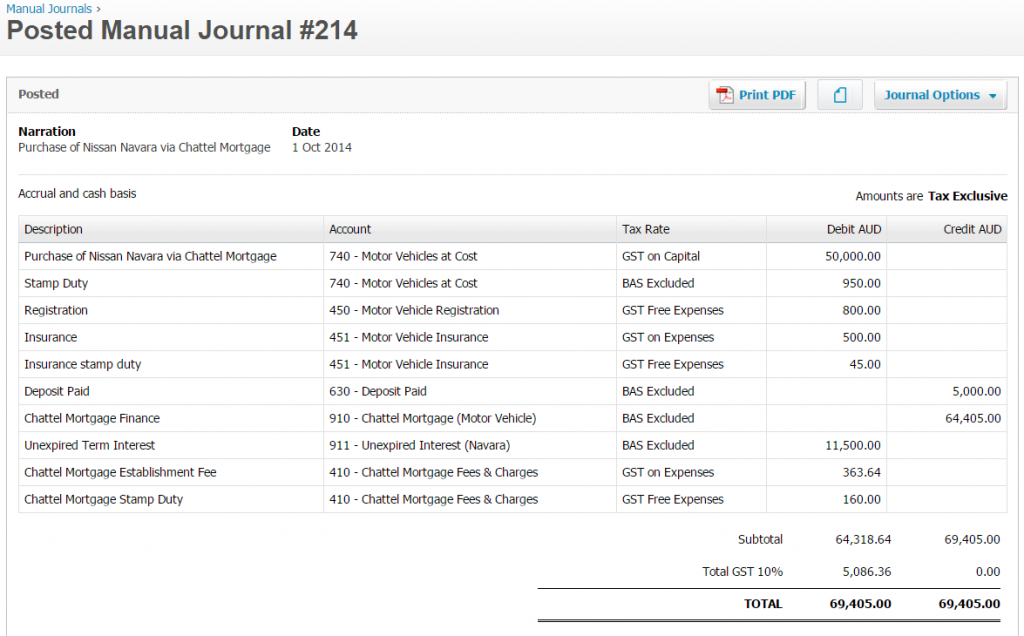

The Bookkeeping Behind An Asset Purchase Via A Chattel Mortgage E Bas Accounts

Ntsa Motor Vehicle Search In Kenya Logbook Car Search

How To Record A Hire Purchase Agreement Solar Accounts Help

How Do I Remove A Fixed Asset An Old Vehicle That

Tax Implications Of Financial Arrangements For Motor Vehicles Acca Global

How Do I Remove A Fixed Asset An Old Vehicle That